24 August 2023

A year-long inquiry into the quality of advice was ordered by the previous Coalition government after around 10,000 professional advisers quit the industry, increasing the median price of advice by 40% to $3,500 per year. Following the inquiry, the Assistant Treasurer and Minister for Financial Services, Stephen Jones, released Michelle Levy’s final report of the Quality of Advice Review on 8 February 2023 (Report). The Report makes recommendations for changes to the regulatory framework that apply to the provision of financial advice, aiming to improve the accessibility, affordability and quality of financial advice for retail clients.

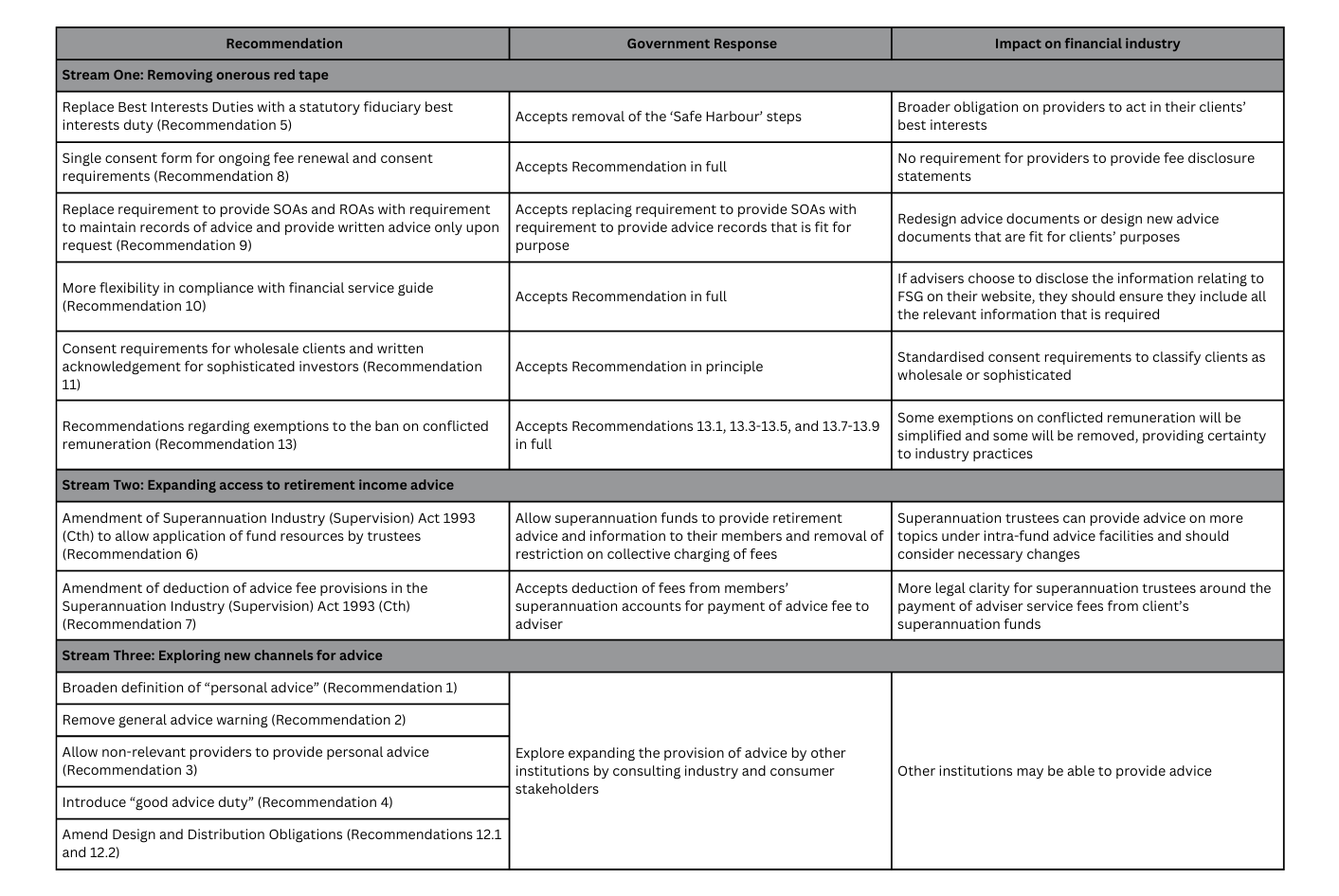

The Government has responded to the Report in its Delivering Better Financial Outcomes package (Government Response), adopting the majority of the recommendations either in full or in principle. The Government Response categorises its acceptance of the Report’s recommendations into three streams, each of which has a common underlying aim:

- Stream One aims to remove onerous red tape that adds to the cost of advice with no benefit to consumers.

- Stream Two aims to expand access to retirement income advice.

- Stream Three aims to explore new channels for advice.

This article provides an overview of the Report’s recommendations, the Government Response and what the implementation of the recommendations may mean for the financial services industry.

Summary of the Government Response

Stream One: Removing onerous red tape

Removal of safe harbour steps from new best interests duty (Recommendation 5)

Presently under the Corporations Act 2001 (Cth) (Corporations Act), the best interests duties and related obligations, which apply to everyone who provides personal advice, include the duty to:

- give appropriate advice assuming the best interests duty is satisfied;

- warn the client if the advice is based on inadequate or insufficient information (Safe Harbour Steps); and

- give priority to the client’s interests if there is a conflict between the interests of the client and the provider or the interests of the client and interests of an associate of the provider.

The Report recommends that the above duties be replaced with a statutory fiduciary best interests duty that reflects the general law, does not include the Safe Harbour Steps, and applies only to financial advisers (that is, relevant providers).

The Government accepts the removal of the Safe Harbour Steps and will conduct consultation regarding implementation of this removal. The Government has not accepted the remainder of recommendation 5 at this stage but will conduct consultation regarding any issues with doing so. The duty to give appropriate advice and the duty to prioritise the client’s interests will continue to apply at this time.

As a result of the removal of the Safe Harbour Steps, relevant providers should:

- review the current processes and systems they have in place and any existing conflicts;

- make any necessary changes to ensure that they are acting in the best interests of their clients, for example more thorough conflict check methods and ways to obtain fully informed consent from clients; and

- where there is a conflict impacting the client’s interests, obtain consent of the client.

Streamlining ongoing fee renewal and consent requirements (Recommendation 8)

Advisers are currently required to provide a fee disclosure statement to their clients, to obtain the clients’ agreement to renew an ongoing fee arrangement and the clients’ consent to deduct advice fees.

The Report recommends that advisers should still be able to obtain their client’s consent to renew an ongoing fee arrangement using a single consent form. This consent form, the Report recommends, should set out the services that will be provided and the fee the adviser proposes to charge over the following 12 months, and should authorise the deduction of advice fees from the client’s financial product.

The Government accepts this recommendation in full. When implemented, ongoing fee renewal and consent requirements will be streamlined into a single form and the requirement to provide a fee disclosure statement will be removed.

Advisers should prepare to simplify their existing processes of providing fee disclosure statements and should consider the changes that they will need to make to the processes as a result of the implementation of this recommendation.

Statement of Advice (Recommendation 9)

Under the current regime, a statement of advice (SOA) is required to be given, with some exceptions, each time a retail client is given personal advice. Advisers have long complained that SOAs tend to be too complex, lengthy, time-consuming and costly, and often do not provide advice in a form that consumers are readily able to understand.

The Report recognised this and recommends that the requirements for an SOA or a Record of Advice be replaced with the requirement for providers of personal advice to retail clients to maintain complete records of advice provided and to provide written advice upon request. The Report also recommends that ASIC should provide guidance on how advice providers may comply with their record-keeping obligations.

The Government accepts recommendation 9 in principle. Instead of removing the requirement to provide SOAs altogether and imposing an obligation on advisers to provide written advice only upon request, the Government will replace the requirement to provide SOAs with a requirement to provide an ‘advice record’ that is more fit for purpose. This will still allow relevant providers to have more flexibility to provide advice in a form that best suits their customers and will reduce unnecessary costs. There will be consultation regarding the final design of such replacement.

Once implemented, advisers will be required to continue to provide written advice but it may be in a different form. Therefore, advisers may need to redesign their advice documents or design new ones. SOAs will likely still be required where appropriate.

Licensees will need to re-consider how they can best discharge their obligations and duties to their clients if the advice documents following implementation cannot satisfy this purpose. Given SOAs often include information about the providers having complied with their duties and obligations and help limit liability in the event of a complaint or a claim from the clients, advice providers should still keep extensive and accurate records of the clients’ instructions, any meetings with the clients, and all steps taken in ensuring that the advice has been prepared and provided in accordance with their duties and obligations.

Financial Services Guide (Recommendation 10)

Presently, a person providing financial service to a retail client must provide a Financial Services Guide (FSG) to the client as soon as it is apparent that a financial service will be provided. If the information in the FSG changes, a supplementary FSG should be provided before the provision of any further financial services.

According to participants in the industry, FSGs contribute to the time, cost and volume of documents that they are required to prepare and provide to their clients, regardless of whether the clients read the FSGs.

The Report recommends that providers of personal advice should have the flexibility to decide how they disclose information that is required to be in an FSG to their clients, whether by way of continuing to provide FSGs or making the same information publicly available on their website.

The Government accepts this recommendation in full. The implementation of this recommendation will provide relevant providers with more flexibility while still ensuring that they make important information available to customers. If an advice provider chooses to make the information available on their website, they should ensure they include information about the remuneration, any other benefits they receive in connection with the financial services they provide, and their dispute resolution procedures and how to access them.

Consent requirements for wholesale clients (Recommendation 11)

The Report recommends that the Corporations Act be amended so that a client must consent to being treated as a wholesale client under the assets and income threshold, and that the existing consent requirements for sophisticated investors should be amended to require a written acknowledgement. The Report recommends that the adviser should be required to explain the consequences of being a wholesale client and the client should be required to sign a written acknowledgment before the relevant financial service is provided. This recommendation aims to ensure that wholesale clients who meet the assets and income threshold, and sophisticated investors, are aware of and agree to the protections they lose by not being a retail client.

The Government accepted in principle recommendation 11. It will introduce standardised consumer consent requirements to classify a consumer as a wholesale or sophisticated client.

Conflicted remuneration (Recommendation 13)

Conflicted remuneration is a monetary or non-monetary benefit that could reasonably be expected to influence the provision of financial advice or recommendation of a financial product to a retail client. There are a number of exceptions to the ban on conflicted remuneration. Recommendation 13 of the Report proposed various changes to these exceptions.

The Government accepts Recommendations 13.1, 13.3, 13.4, 13.5, and 13.7 to 13.9 in full and it will therefore:

- clarify that both monetary and non-monetary benefits given by a client to a relevant provider are not conflicted remuneration, such that the prohibition only applies to benefits given by a product issuer (Recommendation 13.1), and remove any consequential exceptions (Recommendation 13.3);

- remove the following exceptions to conflicted remuneration:

- monetary benefits given for the sale of financial products where advice has not been provided about the product or class of product in the previous 12 months (Recommendation 13.4); and

- benefits given to agents or employees of Australian Authorised Deposit-Taking Institutions (ADIs) for financial product advice about basic banking products, general insurance products or consumer credit insurance (Recommendation 13.5); and

- introduce standardised consumer consent requirements for life, general and consumer credit insurance commissions, which will require informed consent to be obtained prior to accepting a commission (Recommendations 13.7 to 13.9).

Licensees should consider whether benefits they currently receive in reliance on recommendations 13.4 and 13.5 are otherwise caught by the conflicted remuneration provisions. It may be that some benefits are banned as a result of the removal of these exceptions.

The removal of the exception relating to employees of ADIs should help level the playing field between non-ADI and ADI providers.

Stream Two: Expanding access to retirement income advice

Superannuation advice (Recommendation 6)

The Report recommends that the Superannuation Industry (Supervision) Act 1993 (Cth) (SIS Act) be amended to allow trustees to apply fund resources for the purpose of providing personal advice to members about their superannuation and to remove a restriction on the collective charging of fees.

The Government accepts in principle the amendment of the restrictions on the collective charging of fees to allow superannuation funds to provide retirement advice and information to their members. The Government is still considering the scope of the advice that superannuation trustees will be allowed to provide. Superannuation trustees will be allowed to provide advice on more topics under an intra-fund advice facility and should consider the changes they will need to make to training and provision of advice as a result.

Deduction of adviser fees from superannuation (Recommendation 7)

The SIS Act currently prohibits the payment of money from a fund other than to pay a superannuation benefit by members to independent financial advisers for provision of advice. The Report recommends that superannuation trustees should be able to pay a fee from a member’s superannuation account to a relevant provider for the personal advice provided to the member about the member’s interest in the fund on the direction of the member.

The Government accepts this recommendation in principle, and aims to provide superannuation trustees with more legal clarity around current practices for the payment of adviser service fees from the members’ superannuation accounts.

Stream Three: Exploring new channels for advice

Lastly, in conjunction with implementing recommendation 6, the Government will explore expanding the provision of advice by other institutions by consulting industry and consumer stakeholders on recommendations to:

- broaden the definition of personal advice so that it captures more of what is currently defined as general advice (Recommendation 1);

- remove the general advice warning (Recommendation 2);

- allow non-relevant providers to provide personal advice (Recommendation 3);

- introduce a good advice duty which would apply to Licensees and, if the advice is provided by a relevant provider, to that relevant provider (Recommendation 4); and

- amend the Design and Distribution Obligations (Recommendations 12.1 and 12.2).

What’s next?

The Government is currently conducting the consultation process in relation to implementing the accepted Stream One and Stream Two recommendations and responding further to the Stream Three recommendations. The Government aims to finalise its response by October this year. The Financial Services Council will engage the Government as it consults on the three streams and submissions will be developed with input from relevant working groups and board committees. It is expected that consultation drafts of legislation will be developed over the second half of 2023 and early 2024.

While the Report’s recommendations and the Government Response have been largely welcomed by industry, it remains to be seen as to how and when the recommendations will be implemented and put into practice.

Disclaimer: The information published in this article is of a general nature and should not be construed as legal advice. Whilst we aim to provide timely, relevant and accurate information, the law may change and circumstances may differ. You should not therefore act in reliance on it without first obtaining specific legal advice.

View Profile

View Profile

Back to news

Back to news Read article

Read article